In this open letter to EU heads and national leaders, over 1,500 economists,academics, and professionals from all over Europe propose a series of urgent measures in response to the Covid-19 epidemic. They also demand that the EU create a common fund that would issue European securities called “European Renaissance Bonds” to help EU countries overcome the crisis.

The spreading of Covid-19 has determined the most serious global health and economic disruption hitting the whole world since World War II. The health systems, families, individuals and firms across the whole of Europe need an urgent and significant help. The necessary measures include:

– Providing resources to the health systems to cure the infected patients and to prevent new infections.

– Providing temporary unemployment benefits to all workers who will be losing their job.

– Helping families and young, elderly and disabled individuals to satisfy the additional needs resulting from the crisis.

– Providing subsidies and financial assistance to firms that have to cease or reduce their production.

– Financing the education system to implement distance learning.

– Financing the operations of Non-governmental organisations in their role of social support.

– Financing a European-wide investment plan on infrastructures and environment capable of relaunching in a sustainable way the European economy.

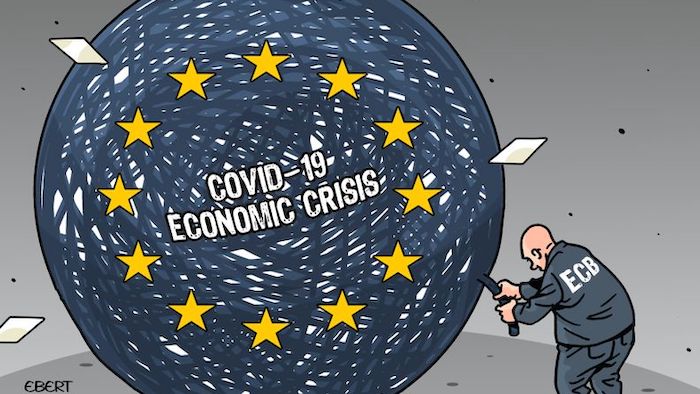

The European Commission has provided 25 billion euros and has suspended the fiscal rules that the European Union countries are subject to. The European Central Bank has eventually provided a 750 billion euros temporary umbrella. It could not be otherwise but, although we appreciate these efforts, we believe that they are not sufficient. An extraordinary fiscal backstop of yet unquantifiable amount will be necessary, but countries cannot be left alone standing on their own fiscal feet.

If that were the case, national debt burdens would explode, no matter how comfortable today’s fiscal space may appear. Hence fiscal measures would lack credibility, thereby determining counterproductive market reactions that would increase risk premia, disrupt European financial markets, and – in the Eurozone – put an excessive burden on the European Central Bank: a remake of the 2010-2012 sovereign debt crises on an immeasurable scale. Even more importantly, any constraint on single countries’ ability to fight the pandemic and its economic consequence is a threat to people in all other countries. If this serious emergency is not correctly addressed, the health and lives of millions of citizens will be under existential threat.

We are facing a Union-wide unprecedented challenge, we need a Union-wide unprecedented strategy.

Therefore, we join to encourage the European Union to do “whatever it takes” to fight the pandemic, relieve citizens’ pains and support the economy across all countries taking an active role in financing, coordinating and implementing the necessary measures. As a result,

We propose that the resources that are necessary to respond to the emergencies that are hitting all European Union countries be collected in a common, centralized fund under the responsibility of the Union’s institutions (e.g. the Commission), avoiding an unsustainable increase in national debts. Any member country should have access to this fund based on documented needs and consistent plans agreed upon with the aforementioned institution; in case of difficulties in reaching a decision, the resources should be distributed to member states on population proportion.

As to the means needed to create the fund, several proposals are being put forward. In line with other appeals that we also subscribe to, we propose issuing Eurobonds, that we suggest calling “European Renaissance Bonds”. These bonds could be backed by some common fiscal capacity or other financial instruments created ad-hoc, considering that the fear of moral hazard cannot play any role under the present circumstances. Moreover, let us stress that this new common debt will not imply any mutualisation of existing sovereign debts but will refer only to the expenses that are needed to face the huge common shock hitting all EU countries. If a collective political determination and consensus emerges, no technical problem is unsurmountable.

After all, why was the European Union created? Why should we, European citizens, stay together if we are not even capable of providing a common response to the common menace that is threatening us? Without a common response the future of the Eurozone and European Union would be seriously at risk.

The EU should transform these difficult days into an opportunity. It is time to prove the true meaning of the long integration process that has created the European Union and the Eurozone institutions. Now a common action is needed urgently to prevent an irreversible damage.

Sign the letter here

First signatories:

Tiziana Assenza (Toulouse School of Economics, France), Andrea Boitani (Università Cattolica, Milan, Italy), Sheila Chapman (LUMSA, Rome, Italy), Nicos Christodoukakis (Athens University of Economics, and LSE, UK), Fabrice Collard (Toulouse School of Economics, France), Paul De Grauwe (London School of Economics, UK), Pompeo Della Posta (Università di Pisa, Italy), Michele Grillo (Università Cattolica, Milan, Italy), Jens Hӧlscher (Bournemouth University, UK), Klaus Kempf (Bayerische Staatsbibliothek, München, Germany), Jackie Krafft (Université Côte d’Azur, France), Luisa Lambertini (Ecole Polytechnique Fédérale, Lausanne, Switzerland), Enrico Marelli (Università di Brescia, Italy), Mario Morroni (Università di Pisa, Italy), Marcello Signorelli (Università di Perugia, Italy), Roberto Tamborini (Università di Trento, Italy), Hans-Michael Trautwein (University of Oldenburg, Germany), Amy Verdun (Leiden University, Netherlands), Hans-Jürgen Wagener (Europa Universität Viadrina, Frankfurt/-Oder, Germany). The complete list of signatories can be found here.